Inspire More! A Better Way To Navigate Wealth

Our expertise lies in developing and executing investment strategies that empower our clients to maintain unwavering financial stewardship and seize opportunities that arise in any market scenario.

INVESTMENT SUCCESS REQUIRES TIME, NOT TIMING .

Aligned To Your Goals;

Customized For Your Needs.

Time spent with each client allows us to understand their specific investment circumstances and objectives, along with their tolerance for risk. Based on this information, we create a detailed investment plan which is.

1. Based on their specific long-term goals and

2. Is sufficiently flexible to adapt to changing life events and capital market conditions.

The result: portfolios are highly customized and specifically aligned with the needs of each client, balancing risks vs. performance, debt vs. equity, domestic vs. international, growth vs. safety and more.

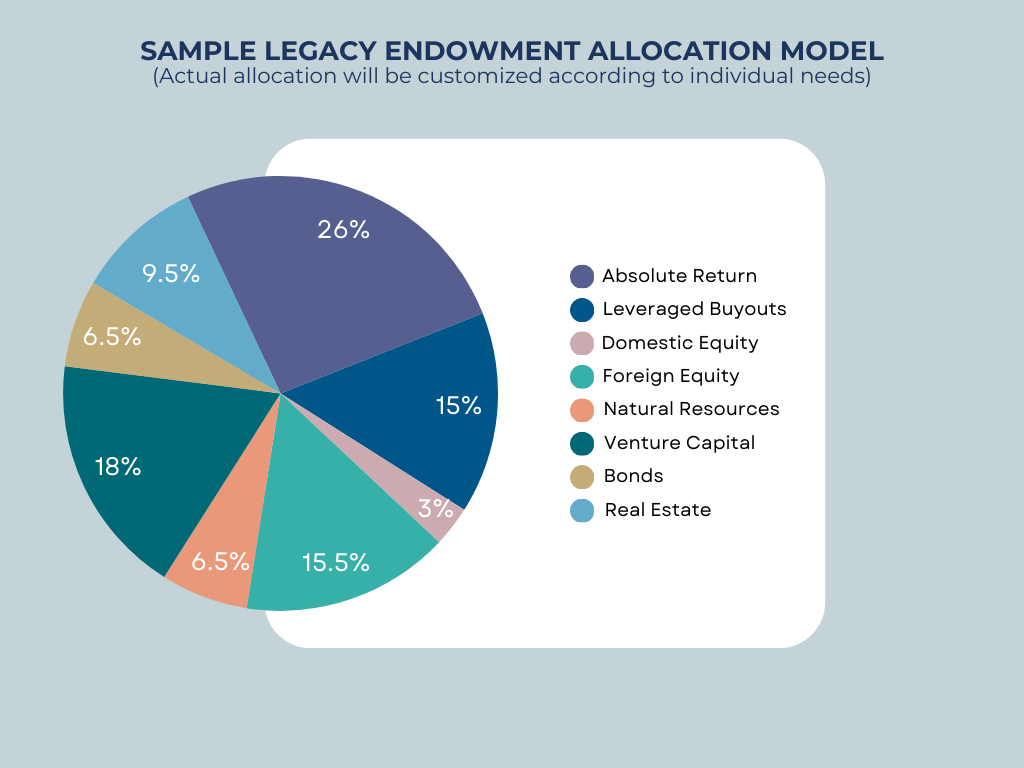

Endowment Model

The endowment model is a long-term investment strategy used by some of the world's largest institutional investors. This approach emphasizes a diversified portfolio of alternative investments, with the goal of low volatility. asset preservation, and long-term consistent growth.

Personalized Planning

Tax Strategies

Intentional Diversification

Our approach to comprehensive planning includes custom portfolio allocation, sophisticated tax strategies, and meaningful diversification, all aimed at protecting and growing your wealth so you can focus on what matters most.

.png?width=150&height=74&name=ETERNITY%20FINANCIAL%20ALLIANCE%20(1).png)